Special Guests

Authors and Titles

Vladimir Goloviznin - The Truth about CLV

PACE - Revenue and Cost Drivers

Vladimir Goloviznin - Unit Economics vs Marginal Analysis | Are there any subject to discussions?

Arrigo Magno - 5 Cost optimization mistakes to avoid for Finance Leaders

Pierre Mévellec - Cost Systems: a renewed approach

Joseph F. EL-Ashkar - The Cash Flow Management & Results

Sonya M. Gonzalez - Cloud Computing and Financial Data Analytics

G. Kapanowski - How Finance Can Destroy Company Value

Douglas T. Hicks - The Navigator and the Management Accountant

G. Kapanowski - Lean Strategy: Customer Focus For Generating Competitive Advantage

Vladimir Goloviznin - The Truth about CLV

Vladimir Goloviznin

I graduated from Stockholm University with a Master degree of Social Sciences with a major in Business Administration in 1997. (Master's program in Banking and Finance).

For more than 20 years I was engaged in corporate finance, management accounting, financial risks and treasury management, including such positions as head of treasury department and CFO, in such industries as banking, FMCG, industrial construction, retail.

Today I teach advanced training courses for practitioners in the field of applied economics and finance, management accounting and corporate finance and expand my research and analytical activity.

Now my attention and research are focused on such a subject as "Unit Economics", both theoretically and practically.

Introduction

to

The Truth about CLV

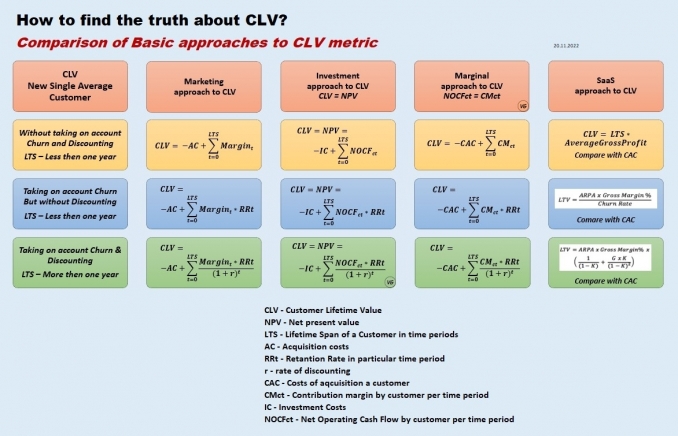

In numerous publications about the CLV (Customer Lifetime value) metric, different authors give different definitions of the metric, use different designations and approaches depending on the task being solved, the context and the conceptual apparatus more familiar to them.

In different sources, the same CLV concept is described from different positions, often using different designations and initial assumptions.

In all these approaches, I have tried to highlight the main thing so that individual preferences in terminology and the choice of designations do not affect the understanding of the essence of the matter.

I hope that for those who are familiar with the CLV metric, the comparison scheme of the most common approaches to CLV looks quite transparent and at the same time allows you better understand the nature of CLV and the technique of its calculation......

The full article is available in the file attached below

Feel free to contact with me if you are interested in to continue the discussion.

https://www.linkedin.com/in/vladimirgoloviznin/

Email: golovizninva@yandex.ru

Given by the author and published on this website in 2022

PACE - Revenue and Cost Drivers

The Profitability Analytics Center of Excellence (PACE) is a non-profit community of professionals dedicated to helping organizations make better, more informed decisions through the use of data analytics employing integrated, causal models.

The goal of Profitability Analytics is to provide managers with information based on sound economic principles (independent of external financial reporting requirements) to enhance organizational decision making. It achieves this through the development of integrated models of an organization's revenues, costs, and investments based on an operational understanding of an organization and aligned with its overall strategy.

For Info e Contacts:

www.profitability-analytics.org

Twitter at @pace_coe

REVENUE AND COST DRIVERS

Revenue and cost drivers refer to identifiable parts of business operations, such as service outcomes or activities, that explain the amount of revenue earned or cost incurred.

Cost drivers are incorporated in many management accounting techniques to help measure resource use or describe how operations and objectives cause costs.

The revenue management levers mentioned previously can also be interpreted from a revenue and cost driver perspective.

Revenue drivers and how they can be modeled in conjunction with established cost driver models are described in this section and show how revenue management thinking can be integrated with cost management and resource thinking..........

The full article is available in the file attached below

Given by PACE and published on this website in 2022

Excerpt from "Revenue Management Fundamentals" available on www.profitability-analytics.org

Vladimir Goloviznin - Unit Economics vs Marginal Analysis....

Vladimir Goloviznin

I graduated from Stockholm University with a Master degree of Social Sciences with a major in Business Administration in 1997. (Master's program in Banking and Finance).

For more than 20 years I was engaged in corporate finance, management accounting, financial risks and treasury management, including such positions as head of treasury department and CFO, in such industries as banking, FMCG, industrial construction, retail.

Today I teach advanced training courses for practitioners in the field of applied economics and finance, management accounting and corporate finance and expand my research and analytical activity.

Now my attention and research are focused on such a subject as "Unit Economics", both theoretically and practically.

Introduction

to

Unit Economics vs Marginal Analysis –

Are there any subjects to discussion?

Recently, the term Unit Economics has been gaining more and more popularity in the publications of internet marketers and practitioners from the venture capital industry. As a rule, in the majority of such publications concerning the Unit Economics, terminology and methods well known in generally accepted economic models are not mentioned directly or reference to them is given in an implicit form. Most often, the term Unit Economics is mentioned in the application to the SaaS business model, Internet services, Internet business, and the assessment of the perspectives of start-up companies.

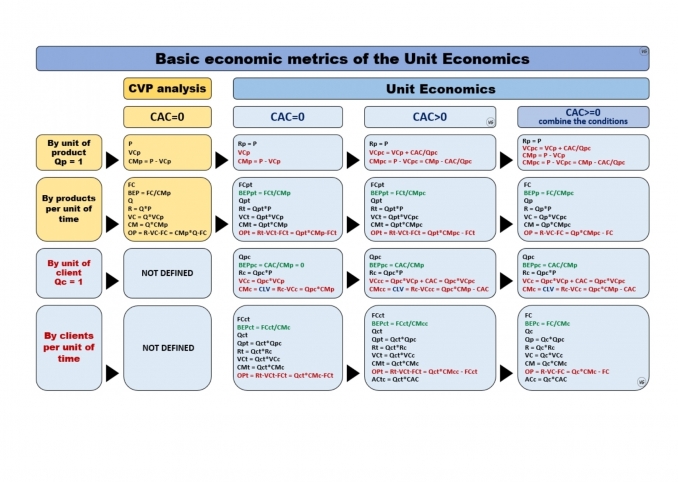

My view is that applied economics has always been and remains Unit Economics. It means that the economics of any company has always been considered and can be viewed through the prism of certain Units for measuring the processes and results of the company's activities.

Let's take CVP analysis as a basis to illustrate the proposed thesis, in order to concretize the stated position with an example. This model has been well known for a long time. But the most important thing is that it explicitly uses Measurement Units to describe the company's economics, such as a Product Unit. For those familiar with the CVP analysis model, the logic of the diagram below (see the image at the bottom) should be fairly transparent. The meaning of the scheme is that the same operating profit of a company can be expressed both through the Product Unit and through the Customer Unit, even in case when the CAC metric - the cost of attracting a customer, can also be included in the model ……….

The full article is available in the file attached below

Feel free to contact with me if you are interested in to continue the discussion

Email: gfactors@yandex.ru

Given by the author and published on this website in 2021 and updated in 2022

Arrigo Magno - 5 Cost optimization mistakes to avoid for Finance Leaders

Arrigo Magno – Finance Business Partner

Despite more than 20 years of experience, I am still passionate about everything that orbits around the world of business and finance.

I have held managerial positions of responsibility in auditing, accounting and financial control in global leading companies I like being considered a Finance business partner both supporting the process decision-making and challenging the business to ensure that its strategies align with financial goals.

Email: arrigomagno@gmail.com

5 Cost optimization mistakes to avoid for Finance Leaders

I recently read an article issued by Gartner (a research and advisory firm providing information, advice, and tools for leaders in HR, IT and Finance functions), about the most common mistakes that companies make in their cost optimization plans.

Considering that most companies (including the one I work for), in the face of the Covid-19 pandemic, have started or are preparing to put in place measures to reduce their cost base, I read the article with great interest.

Here are the most common mistakes I would like to share with you:

∞ making generic cuts with unrealistic goals

Many companies respond to economic crises by setting unrealistic cost savings targets and indiscriminately cutting costs across the board. Across-the-board cuts penalize the most efficient parts of the organization and can cause the erosion of important sources of value.

Indiscriminate cutting costs is the result of a big mistake: confusing Costs cutting from Cost optimization.

Costs cutting eliminate waste and remove capabilities that are no longer part of the strategic plans, thus freeing up resources, time and funds to reallocate on prioritized areas.

Cost optimization improves the efficiency of capabilities that are required today to enable the organization to catch up to, and keep up with, the competitors. It is a continuous effort, deliberately driven, to manage spending and cost reduction while maximizing business value.

In other words trying to get the most out of what we are spending.

Let's see now some typical examples of indiscriminate cutting:

#1 Overtime: the Leadership Team requests to eliminate overtime throughout the organization. If in some departments this can happen without major problems, the total ban on overtime in another department, which is for example working on a sales campaign with a high impact on sales, could generate a loss of value.

#2 Layoff: the more people laid off, the more money saved: correct, right? This is a typical cost-cutting error. Companies must be very careful not to make indiscriminate staff cuts. Talents and people in key roles need to be preserved. The more talented and strategic people are laid off, the more intense the negative effects on business initiatives, performance and outcomes. Besides layoffs mean it will later cost more time and money to restore the workforce when the market recovers.

#3 Long-term investments: When it comes to saving money, it can be tempting to abandon long-term projects, processes or services in favour of more immediate, “plain vanilla” alternatives. Leaders should not automatically sacrifice long-term initiatives just because they are long term. Always keep in mind the value of the business when decide what to cut.

#4 Suppliers: When looking for ways to cut costs, switching a business partner to a less-expensive alternative may seem like a good idea, particularly if the decrease in quality and efficiency has no immediate consequences. This could be a big mistake. Let's think, for example, of changing the supplier who offers the logistics service which constitutes an element of competitive advantage, or changing the supplier of the main raw material of a product recipe. Again, cutting costs without any strategic thinking will likely mean loss of business value.

∞ failing to sustain behaviour change

Most cost-cutting strategies are short term and fail to preserve the behavioural change required for smart spending decisions in the future. Although some costs (such as travel and expense) can be capped by policy rules and restrictions, many costs that were removed inevitably occur again as budget owners and managers pursue spend and initiatives in the name of supporting growth. The result is another painful round of cost reductions when the next crisis hits.

∞ slowing down the organization

Only a small number of companies consistently invest in growth opportunities without creating excessive complexity. Complexity drives almost half of the growth in corporate overhead costs. Whenever new business opportunities are hunted, especially for initiatives that aim to overcome the crisis, it is necessary to evaluate the complexity generated by these, because complexity means both direct costs (for example the proliferation of SKUs) and indirect costs (in terms of slower decision making).

∞ choking off needed innovation

Aggressive cost reductions can drain resources from high-impact innovation. They can also promote an environment where innovators do not feel permissioned to request enough multiyear funding required to ensure their initiatives are successful.

∞ underestimating investments in digital

Although most organizations have plans for digital business transformation, only few have achieved it at scale. More than 50% of CIOs are self-funding their digital business initiatives through cost savings from other budget areas. However, realizing scale from digital efforts requires more substantial funding than what is generated by IT budget savings. Digital transformation is not a zero-sum game: the risk is to face subscale investments in digital that do not generate returns.

Based on my professional experience, I have seen some of these errors reiterated several times. And working in a large structured multinational company is not a guarantee of success in the implementation of cost savings plans.

So how to avoid these mistakes and implement a successful cost cutting plan?

Executive leaders should use a decision framework to evaluate the costs, benefits and viability of different cost optimization initiatives. By selecting some decision factors, they can group and map cost optimization initiatives on a grid: this helps leaders visualize the cost, effort and reward associated.

Examples of Decision Factors are:

Q Potential Financial Benefit expected (Large / Medium / Small)

Q Business Impact (Positive / None / Negative)

Q Time Requirement (short / medium / long term)

Q Degree of Organizational Risk (High / Medium / Low)

Q Investment Requirement (High / Medium / Low)

This method will help in prioritizing the different cost optimization initiatives as shown in the table below.

In any case, the landmark must always be the market and the value of the business. When costs are higher than average, it is natural to look at reducing them. However, executive leaders should be aware when increased spending is leading to above-average performance. Only when increased spending has no link to an increase in business performance, executive leaders should question the expenses.

I think the difference between a successful cost optimization plan and a failed one is in the approach: it is no longer simply a cost-cutting (save-to-turnaround) and not even an optimization of costs for growth (save-to-grow) but rather of a disruptive approach aimed at enabling agile business strategies and digital solutions (save-to-transform).

Easier said than done, but keep trying.

Given by the author and published on this website in 2021